Harris County Property Owners Saved Over $3 Billion in Taxable Value with O’Connor

O'Connor discusses how Harris County property owners saved over $3 Billion in taxable value with our tax reduction services.

HOUSTON, TX, UNITED STATES, September 22, 2025 /EINPresswire.com/ --Harris County is the wealthiest county in Texas. Home to Houston and its suburbs, the county is filled to the brim with residential, commercial, and industrial properties. This also makes Harris County the largest tax base in the state, which is overseen by the Harris Central Appraisal District (HCAD). Across the board, property values and the corresponding taxes have been on the rise for more than a decade. The two main methods to combat this inflation are exemptions and property tax appeals. While once a rarity, especially for homeowners, tax protests are becoming incredibly common thanks to how unaffordable housing has become in recent years.

O’Connor Reduced the Taxable Value of Homeowners by Over $2 Billion

Single family homes are the largest reservoir of value in Haris County, and much of Texas. In 2025, the taxable value of homes combined for a total of $440.80 billion, a historical high. In response to this, a massive number of property tax protests were launched, which eventually brought the total down by 2.7%, for a new combined value of $428.81 billion. This should demonstrate the efficacy of property tax appeals in an overheated market. Our clients brought us $39.45 billion in value to protest for them, which we were able to reduce by 5.5% to $37.27 billion. The biggest chunk of value for O’Connor clients and Harris County was homes worth between $250,000 and $500,000. O’Connor clients saw this reduced by 5.6%, while the average homeowner got a reduction of 2.1%. Homes worth over $1.5 million, the No. 2 category, were reduced 5.9% by O’Connor, while in contrast, homes worth under $250,000 got a value cut of 4.6%. These easily beat the county averages of 4.7% and 1.3% respectively.

When looked at by size, the most common homes in Harris County are those ranging from 2,000 to 3,999 square feet. Even after a solid reduction of 2.8%, these homes still combined for a total of $212.62 billion. After a small cut of 1.7%, homes under 2,000 square feet came in second with $134.13 billion. These two categories of savings represented extensive tax breaks for working families and middle-class people, which helps the community as a whole. Those between 4,000 and 5,999 square feet were reduced by 3.9% and were in third place with a new total of $55.68 billion. Appeals proved their worth even against the largest and most expensive homes on the market, cutting 4.5% from truly mammoth-sized real estate.

When homes are broken down by age of construction, we see the first evidence of the construction boom between 2001 and 2020. 38.9% of all housing value was built in this timeframe, which resulted in a total of $171.93 billion. These key properties were reduced 3.1% thanks to various appeals. Totaling $95.01 billion, homes built between 1981 and 2000 were in the No. 2 spot, even after being cut by 2.7%. Older homes had a strong showing, with those built before 1961 accounting for 14.7% of the total, while those from 1961 to 1980 accounted for 17.2%. These were reduced by 2.2% and 2% respectively. New construction was obviously the fastest-growing type of residential property in 2025, with a total value of $33.09 billion before a decent decrease of 3.6%. The “other” category, which is only for raw land and properties that are under construction, saw a decrease of 3.3% despite being a fraction of the other types.

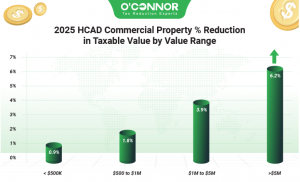

Commercial Property Owners That Used O’Connor Saved 7.4%

Thanks to an appeals blitz from business owners, the massive total of $177.77 billion in combined commercial value was cut an astounding 5.4%, resulting in a new total of $168.15 billion. Like most of Texas, the vast majority of this value came from commercial properties worth over $1.5 million. In this case, $133.32 billion was thanks to the largest of businesses, at least before appeals sliced 6.2% off the value, displaying the true power of protests. Properties worth between $1 million and $1.5 million were reduced by 3.9%, which left a total of $29.67 billion. While these protest numbers were substantial, we at O’Connor were able to improve every single one of them. Mostly notably, O’Connor customers saw a higher overall reduction of 7.4%, easily surpassing the county reduction of 5.4%.

Out of all commercial properties in Texas, apartments are usually the biggest holders of value, something that is very true in Harris County. These multifamily homes combined in value for $67.03 billion in 2025, though they were reduced 5.2% thanks to appeals. Offices were squarely No. 2 in value, though they saw extensive cuts as well, dropping 7.9% to a total of $37.15 billion. Warehouses and retail spaces saw cuts of 3.3% and 5.2% respectively. Hotels had the largest value jump in 2025 but were brought down a good bit thanks to a reduction of 6.5%.

38.5% of all commercial property value was built in Harris County during the construction boom between 2001 and 2020. Property tax appeals were able to cut this down by 4.3%, which brought the total to $64.79 billion. This was followed by those built between 1981 and 2000, which fell 6.3% thanks to appeal, achieving a total of $38.47 billion. New construction has been growing quickly, especially since the pandemic, and already accounts for 4.8% of all property value. These new buildings also saw a respectable decrease of 6.8%. The third-largest category of homes was those built between 1961 and 1980, valued at $37.82 billion before a reduction of 7.1%, which was the highest percentage reduced. Even the oldest homes got a strong decrease of 5.1%.

Apartment Value Slashed by 9.1%

Apartments are the No. 1 business property in Texas, and Harris County has the highest value in the entire state with $67.63 billion. County-wide appeals were able to bring this down by 5.2%, an impressive amount for a combined total. Like other properties, most of this value was built between 2001 and 2020, with 45.7% of the total coming from this date range alone, before it dropped by 3.5% thanks to appeals. Despite their age, the second-most valuable apartments were built between 1961 and 1980, which combined for $15.34 billion before securing a decrease of 7.3%. Those constructed between 1981 and 2000 were in the No. 3 slot and saw a reduction of 5.5%. The largest drop in percentage came from new construction, which was 7.9%, a significant number. Clients of O’Connor saved well over all these numbers, with the total reduction of apartments being 9.1%. This saved our clients a combined total of $487.54 million in taxable value.

While HCAD broke down apartments into five subtypes, over half of all apartment value, $37.42 billion, came from garden apartments alone. 5.6% of this was cut thanks to appeals across Harris County, and they were the biggest savers by far. High-rises and generic apartments came in second and third place, with each being trimmed down by 4.1% and 2.7% respectively. We at O’Connor were able to improve on all these reductions significantly, resulting in an overall reduction in the total of 9.1%. This translated into a value savings of $487.54 million for our clients.

Offices Achieve a Reduction of 8.8%

Offices are the No. 2 commercial property in Harris County, which is pretty typical for urban areas. With a total of $40.32 billion in taxable value, these buildings have come a long way since the pandemic. As return to office initiatives keep chugging along, the value of offices has also increased. Still, taxpayers were able to claw back 7.9% from HCAD in 2025. Not to sound like a broken record, but those built between 2000 and 2020 were the largest subtype, with 45.1% of the total, before a reduction of 5.7%. Overall, we at O’Connor were able to save our clients 8.8%, including 7.1% on the key data range for 2001 to 2020. When everything was added up, this meant that our clients saved over $140.09 million in taxable value.

HCAD divides apartments into three subtypes. The largest was low-rise offices, which amounted to $23.84 billion after a large reduction of 9.1%. These were followed by high-rise offices, which totaled $7.44 billion after another big cut of 5.7%. Medical offices rounded out the set with $5.87 billion after a reduction of 5.3%. These were some of the best reductions of any property type, reflecting the dedication of taxpayers and their representatives.

Retail Owners Saved $150.99 Million

Retail spaces were the fourth most-valuable commercial real estate type according to HCAD. While a combined value of $22.74 billion would top the charts in most counties, these storefronts were pretty far down the totem pole in Harris County. A strong overall reduction of 5.4% managed to get this even lower, resulting in a total of $21.56 billion. While retail stores built between 2001 and 2020 were still No. 1, the total of $7.54 billion was much closer to the $6.20 billion for stores built between 1981 and 2000. These totals were after each had been reduced 5% and 5.5% respectively. Those built between 1961 and 1980 were a close third with $5.62 billion after a cut of 5.7%. O’Connor clients saw even more overall success, with a total cut of 7%. Overall, our customers saved $150.99 million in value.

Anyone familiar with Houston knows the ubiquitous nature of strip malls, they are a constant across Harris County. Little wonder that these storefronts managed a total value of $7.84 billion, before getting cut down 5.7% to $7.39 billion. Neighborhood shopping centers got the largest reduction thanks to a decline of 6.1%, dropping to $4.81 billion. Community shopping centers followed a similar trajectory, losing 5.7% to total $4.28 billion. Single-occupancy stores, otherwise known as big box stores, managed a slight decrease of 2.9%. The smallest category was shopping malls, even though they managed to score a fine reduction of 3.5%. Each category of business benefited from appeals in their own way, but each showcased why a taxpayer should explore them.

Warehouses Achieve a 3.6% Drop in Taxable Value

They say warehouses are recession proof, and according to HCAD, that is very true in Harris County. These kings of storage came in third place for overall value in the county, amassing a combined total of $25.55 billion, before being reduced 3.3% to $24.71 billion. $8.52 billion, or 33.4% of warehouse value was built in the boom period between 2001 and 2020 and was followed closely by $7.61 billion from those built between 1981 and 2000 and $6.76 from those constructed from 1961 to 1980. These were all reduced by 3.2%, 3.1%, and 3.5% respectively. Warehouse owners that turned to O’Connor saved more than the county-wide reductions and managed to bring home a 3.6% cut to the total. Our clients, thanks to their perseverance, were able to shed around $67.55 million in taxable value.

THCAD divides warehouses into only three categories, with the largest by far being generic warehouses. These were responsible for $15.98 billion of the total value, before getting chopped by 3.1%. Mini warehouses came next with $4.77 billion, while office warehouses were assessed at $4.85 billion. These were each reduced 3.9% and 3.5% respectively.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.